Thursday, 21st November 2024, 8PM Represented By: Deepak Poddar

For Business Owners, Directors, CEOs and MDs with turnover 50Lakh and above

450+ MSMEs Transformed by Our Previous Workshop – Is Yours Next?

Exclusive for Active MSMEs in Maharashtra

Expert Insights for MSME Entrepreneurs to Secure Loans Upto 5 crores under CGTMSE Scheme and Accelerate Growth

Hurry Up! Offer Expires Soon

MSME Owners Have Attended This Online Workshop!

MSMES Got Benefited From This Workshop!

Loan Amount Has Been Disbursed Till Date!

Who Should NOT Attend This Workshop?

Who Should Attend This Workshop?

Are You an MSME Facing These Challenges?

Struggling to raise funds due to lack of financial statements or collateral?

Struggling to raise funds due to lack of financial statements or collateral? Stagnant business growth with low turnover?

Stagnant business growth with low turnover? Losing cash discounts due to supplier credit?

Losing cash discounts due to supplier credit? Trouble repaying loans with high interest and multiple EMIs?

Trouble repaying loans with high interest and multiple EMIs?

How This Workshop Will Transform

Your MSME Business

Bypass Traditional Loans

Discover how to obtain interest-free loans and grow your business faster than ever!

Unlock Financial Freedom

Learn how to secure Installment-Free loans and protect your cash flow like a seasoned professional.

Find New Financial Opportunities

Use strategic MSME loans to boost your profitability by up to 50%!

Maximize Your Savings

Save lakhs with smart MSME loans – a financial blueprint every business needs.

Scale Your MSME Business by 10X with Strategic Loans!

Here’s what you’re probably doing now:

Taking multiple loans from different banks

Struggling with EMI repayments that hurt your cash flow.

Paying unnecessary interest on unused loan amounts.

Accepting high-interest unsecured loans for working capital.

BONUS

As a special reward for reaching this part of the page, you’ll receive FREE bonuses worth ₹39,555 when you sign up for the workshop!

Bonus #1

List of Govt. subsidies ranging from 15% to 200% exclusively meant for MSMEs

Bonus #2

Various Govt. financing schemes exclusively meant for MSMEs as per industry specification

Bonus #3

List of 300+ international banks from which you should avoid accepting or issuing Letter of Credit & Bank Guarantee

Bonus #4

List of banks that you can approach for loans under CGTMSE Scheme across India which will save your time hunting for banks

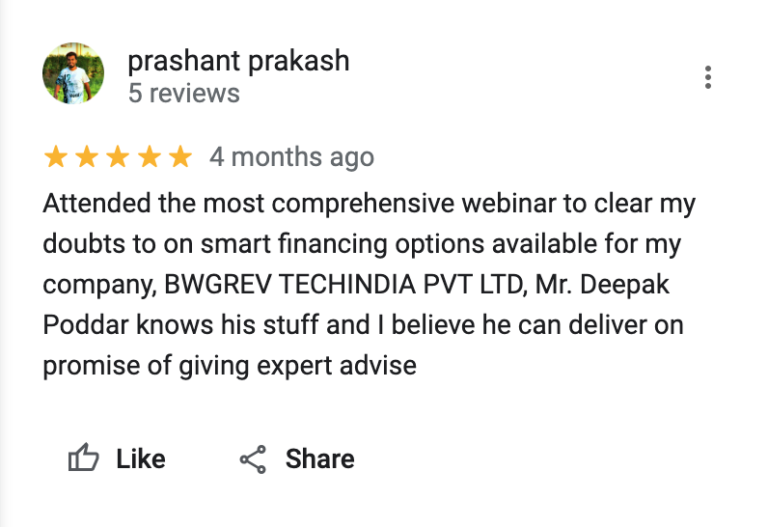

Don’t Take My Word For It!!

Here’s What My Clients Are Saying

Deepak Poddar

Chairman, Balaji Credits & India’s Leading MSME Finance Coach

Hi, I’m Deepak Poddar, and I help MSMEs raise funds strategically to meet their growth goals. With over 20 years of experience in financial consulting, I’ve successfully helped 1,000s of small businesses navigate their financing needs.

During the COVID-19 pandemic, I discovered the secret borrowing strategies used by corporations, and I now share these tactics to help MSMEs like yours thrive.

What Previous Participants Have to Say

4.8

Learn the RIGHT Way to Borrow:

1 STEP

Get loans tailored to your exact business needs, not what’s available.

2 STEP

Borrow based on your future growth projections.

3 STEP

Use corporate-style working capital loans for maximum flexibility.

4 STEP

Secure loans with less than 5% interest per annum.

5 STEP

Pay interest only on the amount and days utilized.

6 STEP

Use smart credit limits instead of traditional business loans or property-backed loans.

Start Your Journey for Just ₹299/- (Limited Time Offer!)

Hurry, this offer expires soon!

More Than 70% MSMEs...

have taken business loans repayable in EMIs instead of installment – free working capital.

More Than 60% MSMEs...

have their CIBIL impacted and slipped to NPA due to wrongly borrowed loans.

More Than 20% MSMEs...

have not yet claimed government subsidies and lost these subsidies ranging from 15% to 200%.

Ignoring the Finance Aspect May Cost a Lot to MSMEs

Here is what you will miss if you’re not aware of the finance secrets I am going to share.

Govt. Sponsored Collateral Free Loans

MSME Loans With Interest as Low as 3% P.A.

Installment Free MSME Loans

Govt. Subsidies for MSMEs

Frequently Asked Questions

Can I Get Working Capital If My Business Is New?

Yes, You Can Get It Provided You Have Your Work Orders In Hand Justifying Your Projected Sales And A Good Tangible Networth.

How Much Working Capital Can I Get Against Property Value If I Have One?

No Property Is Required To Get Loans Under CGTMSE Scheme, However If You Wish Save CGTMSE Fees And Do Have A Property, You Can Get Working Capital As Per Your Eligibility Irrespective Of Property Value.

Am I eligible for government sponsored schemes?

Yes, If you are an MSME involved in any sector like manufacturing, trading or services

How much loan can I get against my property for my MSME business?

There’s no restriction on the loan amount subject to eligibility.

Can I get a loan to purchase land for factory premises?

No, you cannot except you can get loan to construct the factory or shed

Can I get a loan to purchase godown or office premises?

Yes, You Can Also Get Loans Under CGTMSE Scheme To Buy Godown Or Office Premises.

What is Bank Guarantee and Letter of Credit, and how can I use it in my Manufacturing business?

Both are non fund based credit limits and can be used either on the purchase side to extend the number of days of credit or on the sales side. Bank Guarantee can be used for retention money, security deposit or for mobilization advance and letter of credit can be used for purchases either domestic or imported.

Can I get a loan for imported machinery?

Yes, you can use debt instruments such as Term Loan or Letter of Credit for Imported Machineries.

Even if I have collateral and I don’t want to pledge it, am I eligible for MSME loans under government schemes?

As an MSME you are eligible for any MSME loans, just if you have a collateral security and you pledge it, the amount of loan can be increased and even the lenders become more confident

Does the CGTMSE loan under the government sponsored scheme really exist?

Yes, it does exist and multiple MSME’s across India are able to get loan under such schemes

For what purposes can I get a loan if I want to start a MSME business of my own?

You can get a loan for all the purposes of Shed construction, Plant & Machinery, Furniture Fixture, Working Capital, etc…

Copyright © 2024 Balaji Credit Services Pvt. Ltd.

Disclaimer : This is not a part of Facebook website or Facebook Inc. Additionally, this site is NOT endorsed by Facebook in any way. Facebook is a trademark of Facebook Inc.