CGTMSE Scheme Explained: Characteristics, Advantages, Eligibility Criteria, and Necessary Documentation

Trusted by over 5,000 businesses across 20+ cities and towns. Loans worth over 500 crores sanctioned so far.

Request a Free Consultation with an MSME Loan Consultant

Imp: We Provide Our Services only in Maharashtra and Gujarat

Trusted by over 5,000 businesses across 20+ cities and towns. Loans worth over 500 crores sanctioned so far.

Are you a small business owner looking to expand your operations but concerned about securing the necessary financial backing? The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme might just be the solution you’ve been searching for. This innovative scheme is designed to provide financial support and boost the growth of micro and small enterprises, ensuring that they have access to the credit they need to thrive.

Features of CGTMSE Scheme in 2023

Interest Rates

- The interest rates are in alignment with RBI’s guidelines and are eligible for coverage under the CGTMSE scheme.

Eligible Activities

- Manufacturing and services, including retail trade, are permitted.

- Activities such as educational and training institutions, self-help groups (SHGs), and agriculture-related endeavors are ineligible.

Loan Amount

- Micro and Small Enterprises (MSEs) can avail credit facilities up to Rs. 500 lakh on an outstanding basis.

- Regional Rural Banks (RRBs) and select financial institutions can extend credit facilities up to Rs. 50 lakh.

Guarantee Coverage

- Guarantee coverage ranges from 75% to 85% (50% for retail activities).

Collateral / Third Party Guarantee

- No collateral or third-party guarantee is required.

Eligible Member Lending Institutions (MLIs)

- Over 100 MLIs including Public Sector Undertakings (PSUs), Non-Banking Financial Companies (NBFCs), Private Banks, Regional Rural Banks (RRBs), State Urban Cooperative Banks (SUCBs), Financial Institutions (Fls), Small Finance Banks (SFBs), and Foreign Banks.

Annual Guarantee Fee for Amount up to Rs. 1 Crore

- The fee structure has been revised, reduced to as low as 0.37% from the earlier 2%.

Credit Guarantee under CGTMSE Scheme

Credit guarantee entails backing the applicant’s loan by a party without necessitating external collateral or a third-party guarantee. The scheme supports loans sanctioned by member lending institutions, offering a guarantee cover for a significant portion of the loan amount. The CGTMSE scheme caters to both new and existing micro and small enterprises, encompassing manufacturing and service enterprises, providing credit facilities of up to Rs. 5 crores.

Benefits of CGTMSE Scheme

- The ceiling for guarantee coverage has been raised from Rs. 200 lakh to Rs. 500 lakh.

- Guarantee fees have been reduced to lower the overall borrowing costs for MSEs.

- Micro Finance Institutions can now participate as Member Lending Institutions (MLIs).

- Fee concessions and expanded coverage are extended to Scheduled Castes (SC) and Scheduled Tribes (ST).

- Guarantee fee reductions by 10% and increased coverage to 85% are provided for Women, Zero Defect Zero Effect (ZED) Certified Units, and Units in Aspirational Districts.

- The annual guarantee fee structure has been revised, lowering fees to as low as 0.37%.

Eligibility Criteria:

To benefit from the CGTMSE scheme, small enterprises must meet certain eligibility criteria, which may include:

- Classification as a micro or small enterprise as per the definition provided by the Micro, Small and Medium Enterprises Development (MSMED) Act.

- Compliance with the lender’s internal policies and credit appraisal procedures.

- No default history with any financial institution.

Documents Required:

The documentation process for availing of the CGTMSE scheme may vary depending on the lending institution. However, common documents usually include:

- Business plan

- Loan application form

- Financial statements (balance sheet, profit and loss statement)

- Projected financials (if applicable)

- KYC documents of the business owner(s)

CGTMSE Guarantee

The CGTMSE guarantee encompasses credit facilities—both fund-based and non-fund-based—offered by eligible institutions to new and existing Micro and Small Enterprises, including Service Enterprises. These credit facilities are granted without the need for collateral or third-party guarantee. The scheme covers these facilities with a maximum credit cap of Rs. 5 crores.

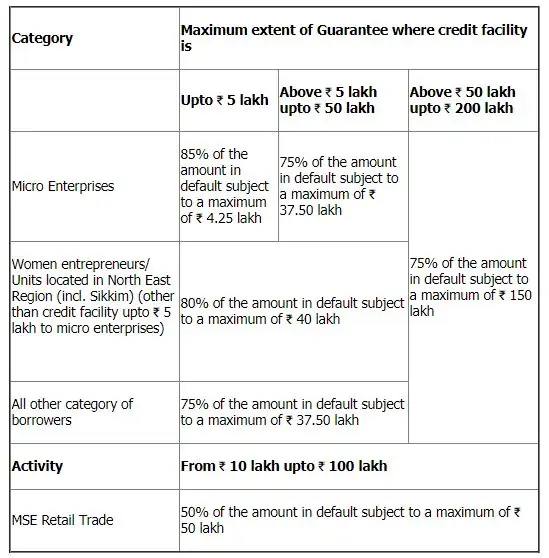

Coverage Criteria under CGTMSE:

a) The trust provides a guarantee for up to 75% of the defaulted principal amount (increased to 85% for a specific category of borrowers). For credit facilities up to Rs. 50 lakh, the guarantee cap stands at a maximum of Rs. 37.50 lakh.

b) The guarantee covers term credit, including interest on the principal, for a quarter or the outstanding capital advances along with interest on the date when the account becomes a Non-Performing Asset (NPA), or on the date of filing the lawsuit (whichever is lower).

c) Additional charges such as penal interest, commitment charges, service charges, or any other fees/expenses are not eligible for the guarantee cover.

The following section provides a comprehensive breakdown of the coverage limit within the CGTMSE scheme:

Steps to Obtain Business/MSME Loan through the CGTMSE Scheme

The process for securing a Business/MSME Loan under the CGTMSE Scheme is as follows:

Step 1: Establishment of the Business Entity

Prior to initiating the loan approval process within the CGTMSE framework, the borrower must establish the business entity. This involves registering as a private limited company, limited liability partnership, one-person company, or proprietorship, depending on the business’s nature. Additionally, acquiring necessary approvals and tax registrations is essential for project execution.

Step 2: Crafting a Comprehensive Business Report

Borrowers are required to conduct a thorough market analysis and create a comprehensive business plan encompassing pertinent details. These details may include the business model, promoter profile, and projected financials. This report is then submitted to the credit facility as part of the loan application process under the CGTMSE scheme. It’s advisable to enlist the expertise of experienced professionals when preparing such project reports, as this can enhance the likelihood of approval.

Step 3: Loan Sanction by the Bank

The bank reviews the loan application, including credit terms and working capital facilities. During this stage, the bank meticulously evaluates the feasibility of the business model, processes the loan application, and grants sanction in accordance with its policies.

Step 4: Attaining the Guarantee Cover

Upon sanctioning the loan, the bank proceeds to apply to the CGTMSE authority to obtain the guarantee cover. If the loan gains approval from CGTMSE, the borrower is then required to make payments for the guarantee fee and service charges. The official CGTMSE loan application form can be accessed and downloaded from the scheme’s official website.

It’s noteworthy that the comprehensive list of Member Lending Institutions (MLIs) participating in the CGTMSE scheme includes 141 banks. This list encompasses major rural, urban, public sector, and private sector banks within India. Prominent banks such as the State Bank of India, United Bank of India, and Punjab National Bank are included in this roster.

Please Note: CGTMSE does not provide loans, credit facilities, or subsidies, nor does it engage in facilitating loans or credit guarantees through Loan Agents or Agencies. The scheme operates exclusively through its Member Lending Institutions (MLIs).

Frequently Asked Questions (FAQs)

Q. What is the duration of the lock-in period in CGTMSE?

A. The lock-in period within CGTMSE spans 18 months.

Q. Which entities are qualified to provide loans under this program?

A. All scheduled Member Lending Institutions (MLIs), encompassing Public Sector Undertakings (PSUs), private and foreign banks, as well as select regional and rural banks, along with any bank directed by the Government of India, can avail the guarantee cover under this scheme.

Q. Does the Mudra loan fall under the scheme's coverage?

A. No, the Mudra loan is not included in the scope of the CGTMSE scheme.

Q. When can eligible lending institutions apply for guarantee cover in relation to eligible credit facilities under the scheme?

A. Eligible lending institutions must establish a one-time agreement with CGTMSE to become MLIs of the trust. Afterward, MLIs can apply for guarantee cover for eligible credit facilities sanctioned to eligible borrowers. MLIs can apply for guarantee cover in respect of credit proposals sanctioned within the quarters of April-June, July-September, October-December, and January-March before the respective quarter concludes.

Q. Are small road and water transporters eligible for coverage within the scheme?

A. Certainly, they are. Small road and water transport loans that receive approval from MLIs are eligible for coverage under this initiative. Entrepreneurs operating in these industries who seek loans can request the addition of CGTMSE coverage to their loan applications.

Q. Does the CGTMSE scheme cover co-financing with a commercial bank?

A. Yes, the scheme covers joint financing between a financing institution and a commercial bank. For instance, an MSE unit can acquire a term loan from a state financial institution and obtain working capital funding from a commercial bank.

Q. Can an eligible lender offer either a term loan or working capital alone and still avail coverage under the guarantee scheme?

A. Absolutely, any eligible lender can extend either a term loan or working capital facility separately and still qualify for guarantee coverage under the scheme.

Q. Is it possible to pay the annual guarantee fee even after filing a claim?

A. The annual guarantee fee can indeed be paid after submitting a claim, but it must be settled prior to the disbursement of the initial 75% installment of the guaranteed amount. However, claims cannot be lodged before the expiration of the initial lock-in period or after the conclusion of the guarantee cover’s tenure.

Q. Is obtaining an IT-PAN mandatory for a borrower to become eligible?

A. Yes, obtaining an Income Tax Permanent Account Number (IT-PAN) is necessary for the borrower before availing facilities from the MLI. This is in accordance with section 139A(5) and section 272C of the Income Tax Act, 1961.

Q. Must the borrower acquire all credit facilities from a single MLI?

A. Credit facilities can be extended jointly and/or separately through more than one MLI to any eligible borrower, with a maximum cap of Rs. 200 lakh per borrower.